The payments industry is enjoying fast-paced progression and growth; and yet our recent survey on cross border B2B payments suggests that businesses continue to be subjected to high transaction fees, FX fees, and slow payment processes when dealing with international payments.

The ways in which PSPs, acquirers, issuers and merchants conduct their international B2B payments does vary, however, a shared consensus that time and resource is lacking, paints an all too familiar story in the challenges they face.

The B2B payments landscape in 2016

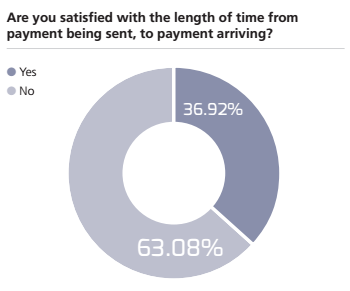

Traditional bank transfers are used for cross border payments by 67% of respondents, and 63% are dissatisfied by the timescale in which payments are sent and then received. This data reveals there is significant room, and desire, for improvement.

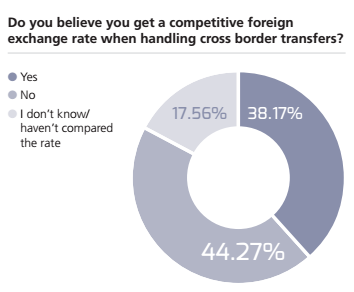

Almost half (48.09%) of respondents do not believe they are getting a good deal in terms of the rates they pay to handle cross border transfers; only 38% feel they get a competitive FX rate.

Despite these figures, many admit they have not looked into more cost-effective and efficient payment options, citing lack of time as the main reason.

Upon closer inspection

High transaction fees are a major issue for many organisations when it comes to international B2B payments. Of the card issuers who completed the survey, 31% pay 3% or more per transaction.

To put this into perspective, the table below shows the difference in cost for sending an international payment of £1,000, based on the charges applied (from 0.25% right up to 20%).

| Fee based on transaction of £1,000 (%) | Fee based on transaction of £1,000 (£) | Transaction cost total (including fee) based on transaction of £1,000 (£) |

|---|---|---|

| 0.25% | 2.50 | 1002.50 |

| 0.50% | 5.00 | 1005.00 |

| 1.00% | 10.00 | 1010.00 |

| 2.00% | 20.00 | 1020.00 |

| 3.00% | 30.00 | 1030.00 |

| 4.00% | 40.00 | 1040.00 |

| 5.00% | 50.00 | 1050.00 |

| 6.00% | 60.00 | 1060.00 |

| 7.00% | 70.00 | 1070.00 |

| 8.00% | 80.00 | 1080.00 |

| 9.00% | 90.00 | 1090.00 |

| 10.00% | 100.00 | 1100.00 |

| 11.00% | 110.00 | 1110.00 |

| 12.00% | 120.00 | 1120.00 |

| 13.00% | 130.00 | 1130.00 |

| 14.00% | 140.00 | 1140.00 |

| 15.00% | 150.00 | 1150.00 |

| 16.00% | 160.00 | 1160.00 |

| 17.00% | 170.00 | 1170.00 |

| 18.00% | 180.00 | 1180.00 |

| 19.00% | 190.00 | 1190.00 |

| 20.00% | 200.00 | 1200.00 |

Taking into account the high volume of payments handled by these businesses on a daily basis, 3% could be an obstructively high rate, especially for smaller businesses with more limited cashflow. Not only does this eat into a business’ profit margins, but it may also mean their customers are forced to foot the bill, taking away the competitive edge in a crowded marketplace.

What needs to be done?

Whilst the payments landscape is continuously evolving, every new opportunity brings new challenges. Businesses looking to implement a more efficient payment strategy in terms of timescale and cost will need to work to overcome the barriers of global trading, and seize the opportunities available.

For many, this will involve a substantial shift of priorities in favour of the payments process, which is often overlooked. For businesses relying on the sale of goods and services across borders, securing the best payment solution is highly beneficial in terms of remaining competitive, providing the best customer service and earning a profit.