In an uncertain economic climate, banks are nervous about lending, and SMEs are nervous about borrowing. Yet, financing is an essential part of growing a business. Whether it’s purchasing equipment, hiring new staff, expanding into new markets or buying inventory, access to cash is critical for small businesses to succeed and expand.

Banks have long dominated the lending market, but small businesses are starting to seek alternative lenders who are able to provide more transparent and fair solutions, as well as better rates, lower fees, and more flexible repayment options.

Stuck in a rut

There are plenty of incentives for consumers to switch banks, however, only a small percentage have decided to move banks to get a better deal. Complacency seems to be a huge factor in this, but concerns about how difficult it may be to move banks is also a barrier.

For day to day banking, an incumbent has traditionally provided everything a small business needs, so what would make them choose to seek out an alternative when it comes to lending?

To find out more about the challenges in accessing funding, we asked 500 UK SMEs about their experiences with traditional and non-bank lenders.

The need for greater flexibility

Loans of one to three years were the most popular form of financing amongst all respondents. Larger SMEs are more likely to take out this type of loan (68%), compared with microbusinesses (36%), who are more likely to require financing on a short-term basis. In addition, 60% of SMEs with fewer than 50 employees had to use an overdraft facility as a short-time financing solution.

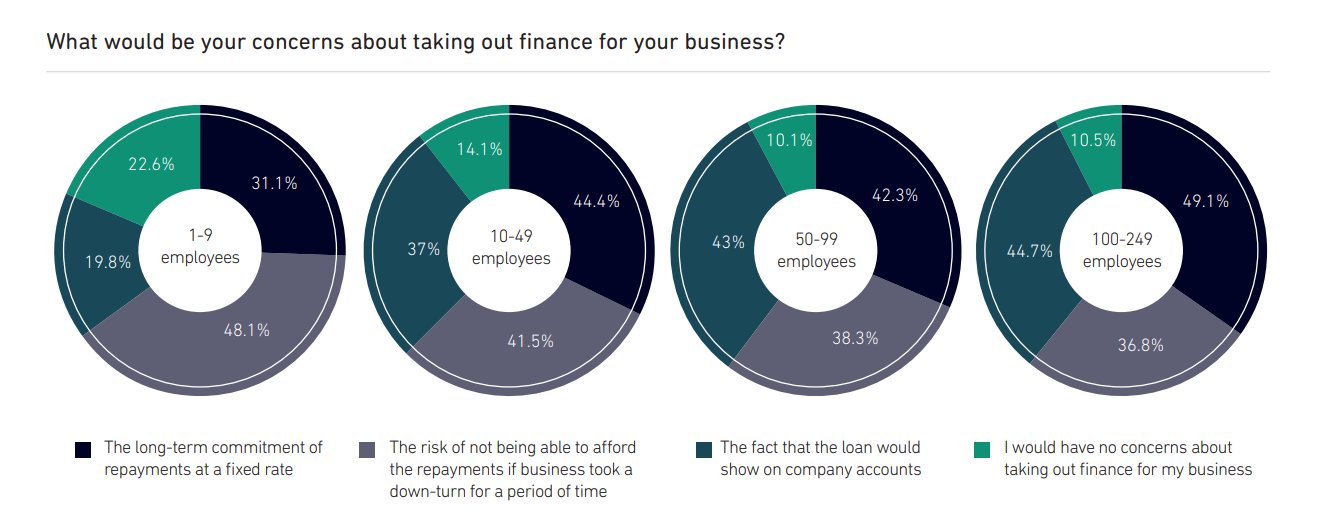

This demonstrates that there is no one-size-fits-all approach to financing a business, yet there is little flexibility when it comes to making repayments. 42% of SMEs stated that the long-term commitment of making repayments at a fixed rate was a concern; 41% were concerned about not being able to make repayments if the business experienced a downturn for a short period. Nearly a quarter (24%) said that inflexible payment options would prevent them from using their existing bank for a loan.

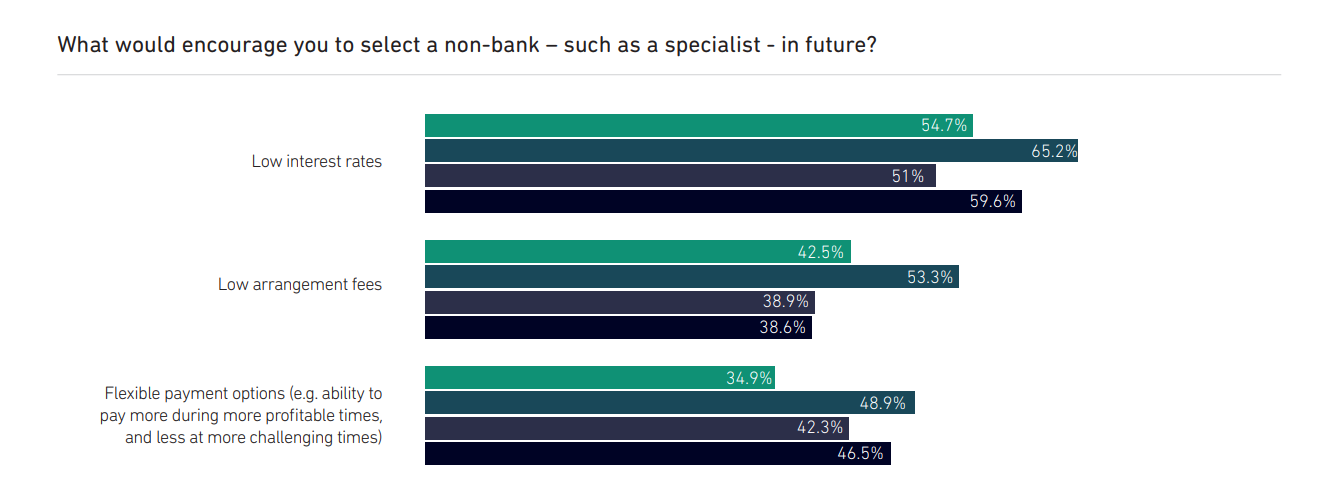

The ability to make repayments at a time that suited the business was one of the top three reasons an SME would consider a non-bank lender.

Costs still causing the most friction

Of all the respondents, whether or not they have had problems borrowing from their bank in the past, almost half admitted they might be prevented from borrowing from their usual bank because of high-interest rates (48%) or set-up fees (42%).

Low-interest rates and low arrangement fees were the main factors in encouraging SMEs to opt for a non-bank lender, but only a third of SMEs have already used a non-bank provider to fund their business.

Delivering value to the end user

Existing business lending models are slow, expensive, and inefficient, and SMEs deserve more. Yet, despite the pain points SMEs face when it comes to lending, it may come as a surprise that so few have sought alternatives.

Although it is encouraging to see alternative solutions entering the market to help businesses achieve their ambitions, whether the majority will be willing to take a chance on an alternative lender is yet to be seen.

To find out more about the challenges faced by SMEs, complete the form below to access our white paper: ‘The epic loan battle: SMEs fighting for finance’.

"*" indicates required fields