As the name suggests, FinTech is a sector that delivers financial services and products through innovative technology solutions. The concept itself is nothing new, so why has FinTech only become mainstream in the last few years?

What is FinTech?

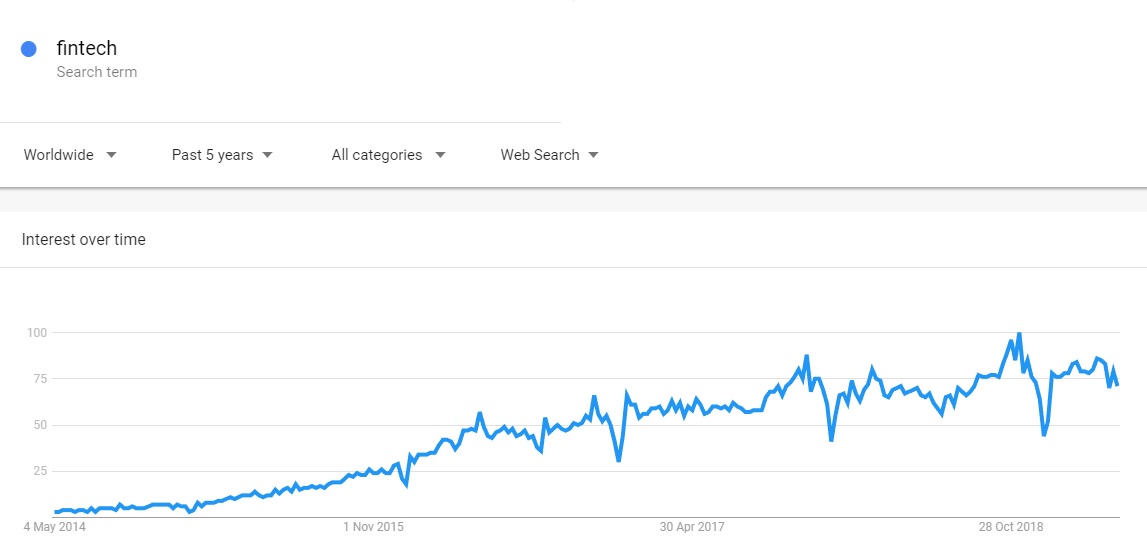

The term ‘FinTech’ was relatively unknown five years ago, yet there are plenty of established companies out there that would be now labelled as one. Lines are often blurred when it comes to determining when a tech company becomes a FinTech. PayPal is an example of a FinTech that has been around since the late 90s, as have many other e-wallets and Payment Service Providers.

So, FinTech is a hot topic – but why now?

After the financial crisis hit a decade ago, things didn’t look too good for the banks. They tightened their belts when it came to lending, interest rates took a nosedive, making saving less appealing, and moving money around was still slow and expensive. Despite all this, banks held onto their monopoly, in part, but this was because there were simply no alternatives.

Then things began to slowly change. Technology, and particularly the increased adoption of Smartphones, had a significant impact on how we live our day-to-day lives. The dependency on connected devices is so great that it’s now almost impossible to remember a time we didn’t have a computer in the palm of our hands, ready to access information whenever we need it. Many industries recognised this shift in behaviour and embraced it, but incumbents providing financial services still lagged behind when it came to digitisation.

Following the crash, regulations were tightened, but in recent years, the landscape has begun to open up again to keep pace with innovation seen across other industries. PSD2 and the Open Banking initiative are two examples of regulations that resulted in the financial ecosystem being opened up to new entrants.

These factors combined created the perfect storm for new FinTech companies to flourish.

Why is FinTech important?

FinTech has increased competition in the financial services industry. Payments is one area that has seen an enormous number of companies springing up to compete with banks. Whereas previously a consumer would have had to send money abroad using their bank at an average transaction fee of £25 – plus FX commission on top – and then wait several days for the payment to clear – there are now plenty of FinTechs who can send money across borders for a fraction of the cost, instantly.

The same goes for lending. FinTech lending platforms offer alternative financing solutions at better interest rates and lower fees for individuals and businesses alike. And many provide more flexible repayment options, too.

Managing money has become far more accessible because of FinTech. Although lots of major banks have invested a lot in improving the user experience for online and mobile banking, the majority do not offer financial management tools that people need to take care of investing, budgeting, spending, and saving on the go. For these niche banking services, FinTechs are cleaning up.

Can FinTech fix financial services?

FinTechs are still heavily reliant on partnerships with banks. Gaining access to banking infrastructure is costly and time-consuming, so for many, using an established financial institution as an intermediary is the only way to get a foot in the door.

This isn’t always a bad thing. Banks are learning from their more agile counterparts, and are forging new relationships to provide better products and service to their end users.

FinTech solutions for businesses

While the FinTech revolution has come on leaps and bounds on the consumer side, innovation in B2B has been somewhat stifled until very recently.

As banks have begun seeing FinTechs less as the competition, and more as collaborators, optimised products and services that started life as B2C solutions are finally available for businesses. This has been especially important for small businesses, which have been underserved for decades.

Financial inclusion is a term often associated with consumers, but businesses have struggled to access banking services for a long time, too. The lack of choice in the marketplace has stifled growth. Now, FinTechs are stepping up to address issues across a number of core banking services.

Some examples of FinTech solutions now available for businesses include:

- Lending

- short-term, flexible business loans

- invoice financing

- Payments

- faster and cheaper for clients and their end users, even when made internationally

- transparent fees and lower FX rates

- Accounts

- easier to set up than ‘traditional’ bank accounts – can be done completely online due to improved KYC/onboarding which has automated many processes around fraud detection and credit

- checks

- prepaid solutions for better cash management and zero risk of debt, and because there are no credit checks, any business can open this type of account

- money can be moved between accounts held with different banks thanks to Open Banking quickly, and without cost

These new ways of delivering commercial banking solutions could energise the economy, as businesses are finally able to spend less on fees and interest, and instead focus on investing cash back into their companies.