Many people wonder exactly what ‘FinTech’ means. FinTech is short for ‘financial technology’ – something that has actually been around for a very long time. Once flagged as a concern for traditional financial service providers, FinTech is no longer so much about disruption, but focuses instead on collaboration. Put simply, FinTech refers to the technology that is driving innovation in the financial services industry.

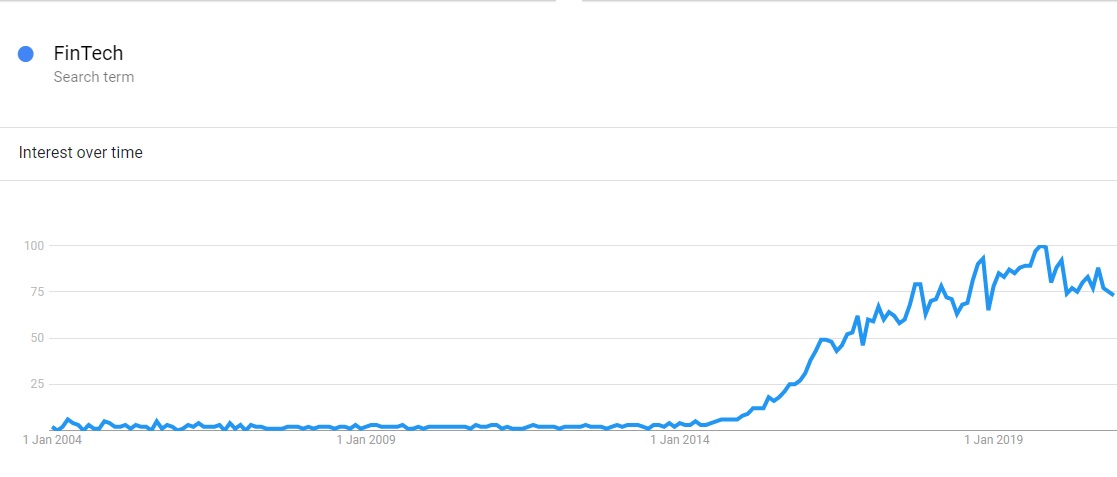

The term has become far more widely used in the last five years, with new terminology associated with FinTech also springing up.

New buzzwords, jargon and acronyms are commonplace when talking about the industry, and so we hope to explain, in clear terms, exactly what some of them mean.

We have already covered many common terms and acronyms in our payments glossary, which can be downloaded here.

Account Information Service Provider (AISP)

Account Information Service Providers (AISPs) grant third parties access to financial information by consolidating and aggregating account information, provided the account holder has given explicit permission to do so. Examples of this include credit scoring, lending and budgeting websites and apps. By collecting data from financial institutions via an API, an AISP can provide customers with faster decisions on loans, show them credit cards for which they are likely to be approved, or help them to calculate where they could save money.

AISPs do not have access to the funds in a customer’s account at any time – their purpose is to share financial information which it has compiled securely and digitally – eliminating the need for customers to submit payslips and bank statements or enter their financial information manually.

Access to Account (XS2A)

Access to Account (XS2A) allows third parties to access the bank accounts of customers, with permission, via an API. This allows Account Information Service Providers (AISPs) to access information about accounts and balances, and Payment Initiation Service Providers (PISPs) to initiate payments without going through the traditional payment networks (such as credit cards).

Application Programming Interface (API)

Application Programming Interfaces (APIs) are software intermediaries that allow the back ends of software and services to communicate with one another. This makes it easy for applications to connect and share data in real-time.

In the context of banking and payments APIs, one example of APIs being utilised in a number of banking apps is account aggregation, which lets users connect to accounts they hold with other banks to pull all of their financial data into their main banking app with just a few clicks.

Banking-as-a-Service (BaaS)/Banking-as-a-Platform (BaaP)

Banking-as-a-Service (BaaS) generally refers to the integration of banking services digitally, which are open to FinTech and other non-bank third parties via APIs and web platforms. This means that payments businesses that serve online merchants can access banking services (for example, international payments) via a bank’s API, and offer this to their customers without having to build the infrastructure themselves or acquire the necessary regulatory licenses.

Banking-as-a-Platform (BaaP) refers to banks and other financial institutions integrating services provided by FinTechs and other technology companies into their existing infrastructure, enabling them to offer products, features, and services that they otherwise would have had to build themselves.

Both BaaS and BaaP are about players in the financial services ecosystem working together to offer end users access to new products and services without having to invest heavily in developing the technology themselves. In both scenarios, entities operating within the finance sector can pick and choose from a marketplace of services that can enhance their own value proposition.

Challenger Banks

Challenger banks, as the name suggests, have entered the market as competitors to traditional, established, high-street banks. They hold a banking licence and operate almost exclusively online, with the focus on utilising technology to enhance the products and services they offer.

Within the umbrella of challenger banks, there are also institutions described as neobanks or digital banks. Neobanks and digital banks do not have a physical presence and instead reach their customers from web platforms and mobile apps.

Cloud Banking

Cloud banking is allowing banks to move all or part of their infrastructure to virtual environments. By moving their banking infrastructure to the cloud, banks have access to a scalable, manageable technology model that reduces IT hardware, maintenance and development costs.

Cloud banking offers greater flexibility, providing alternative ways to access core banking technology, the ability to store and manage large amounts of data more easily, and faster integration with new applications, allowing products and services to be launched more quickly.

Financial Inclusion

Although the term financial inclusion has been around for a while, it was primarily used to refer to access to personal banking products for those considered unbanked (unable to access any traditional banking products, such as a bank account) and underbanked (those only able to access limited banking services, but often with high fees or limitations due to their financial status). FinTechs have been instrumental in supporting the unbanked and underbanked by offering solutions that traditional banks were not willing to, such as prepaid bank accounts and mobile payment solutions.

In the past few years, the term ‘financial exclusion’ has also been used to refer to small businesses and startups that have struggled to access the same banking services as their corporate counterparts. Increasing financial inclusion is about levelling the playing field so that everyone can benefit from access to financial services, which in turn helps with economic growth.

Multi-Factor Authentication (MFA)

Multi-factor Authentication is a verification method that requires a user to provide two or more ways of confirming their identity before they gain access to an app or online account. Common forms of MFA include SMS verification after already logging in with an email address, providing digits or characters from a PIN or password, fingerprints and facial recognition, or confirming access via another connected device.

In the context of financial services, MFA is commonly used when setting up new beneficiaries. Take online banking as an example, where a card reader is needed to make a payment to someone who you’ve not made a payment to previously. These measures help to significantly reduce fraud, while helping financial institutions meet compliance requirements.

Open Banking

Open Banking is an initiative that has opened up the financial ecosystem by providing open access to consumer banking, transaction, and other financial data from banks and non-bank financial institutions through the use of application programming interfaces (APIs).

This has allowed for increased collaboration between entities, which has resulted in improved customer experiences, access to new products and services, and lower costs for end users.

Payment Initiation Service Provider (PISP)

Payment Initiation Service Providers (PISPs) are regulated payments businesses that are authorised to execute payments on a customer’s behalf from their bank account – as long as they give explicit consent.

In addition to having consent, payments businesses must provide information on what the nature of the service is, how they will use your data, and whether this data will be shared with any other third parties. PISPs do not manage a customer’s money – they simply act as the mechanism to trigger transactions. Customer account data is never made available to the PISP, payment gateway, or the merchant.

PISPs have allowed for a wider range of payment options to be made available to end users. Instead of only being given the choice of paying by credit or debit card, end users can now use a huge range of alternative payment methods. Once a user has given permission for an alternative payment provider to access their online bank account, the provider can trigger the transaction in real-time.

Transactions are initiated via an API by a PISP, and permission to gain access is granted once the customer has confirmed the payment can be made. This form of access to the customer’s online banking account is known as Access to Account (XS2A).

For online merchants, PISPs have provided a simple and secure way of introducing new payment methods to their customers, helping to reduce cart abandonment and improve the user experience. Because payments have to be initiated by the customer, the risk of payment fraud is also reduced.

RegTech

RegTech is an abbreviation for Regulatory Technology. RegTech is being used to digitise regulatory and compliance checks within the financial services industry, improving efficiency and reducing costs.

RegTech has already begun to transform financial services by delivering solutions that help to prevent fraud, identify payments associated with money laundering, and automate due diligence.

Strong Customer Authentication (SCA)

Strong Customer Authentication (SCA) was introduced to reduce fraud and make online payments more secure by adding extra levels of security.

While this is not enforced yet, come September 2021 banks across the UK and Europe will need to perform additional checks (multi-factor authentication, or MFA) to confirm a consumer’s identity when they make payments. Examples of this include passwords/PIN numbers, mobile devices or card readers, or biometrics such as fingerprint or facial recognition.

This means that card payments and bank transfers will be rejected by the customer’s bank if they do not pass the requirements of SCA. There are a few exceptions to this, including some low-value payments (less than €30), low-risk payments (providing they are below acceptable fraud rate thresholds), and fixed-amount subscriptions.

Although SCA will help to fight fraud, European consumers can expect an extra layer of friction at the checkout changing the way they make purchases online.

Want to brush up on even more payments terminology and acronyms? Take a look at our glossary.