Payments businesses have established themselves as essential providers of financial services, carving out a key role in the booming e-commerce segment. Now, they’re seeking to broaden their capabilities by offering a full suite of banking services to their customers – forcing banks to examine their own role in this expansion. Meanwhile, emerging financial infrastructure platforms, with no ambition to serve the online merchants themselves, are actively positioning to enable this transition.

In a recent Banking Circle webinar, Søren Skov Mogensen, Chief Growth Officer at Banking Circle, and Albion Murati, Partner at McKinsey & Company, discussed the changes we’re seeing in the payments sector, how payments businesses might orient themselves for the future, and who will win in the competition for the merchant relationship.

The session was moderated by Esther Groen, an adviser to Holland FinTech and an Executive Board member of the European Women Payments Network.

You can watch the full webinar on demand here, or read on for our summary of the key takeaways from the event.

How is the payments landscape changing?

“Major strategic shifts are happening in the payments sector,” said Søren Skov Mogensen, Chief Growth Officer at Banking Circle. Payments businesses are expanding geographically and looking strategically at ways to broaden their proposition and to strengthen their position in the market, Søren explained.

The payments sector is one of the most attractive in the financial services ecosystem when it comes to value creation, according to Albion Murati, Partner at McKinsey & Company. The boom in e-commerce that has happened in recent years – accelerated in no small part by the COVID-19 pandemic – looks set to continue and to create even greater opportunities in payments, Albion went on to say.

But the flip side of that growth potential is an ever-more competitive landscape. “Staying relevant in payments is becoming increasingly difficult,” Albion said. As global online marketplaces have experienced high-level growth and captured a significant portion of e-commerce payments, they have also sought to build their own payments capabilities – which has a knock-on effect on the experience that customers come to expect.

“From the moment that merchants and consumers start having some experiences shaped by digital natives, global marketplaces or tech players, they want and expect that in all situations,” Albion said.

As a result, today’s payments players need to re-think their business models and consider expanding their capabilities in order to remain relevant to merchants.

What are the strategic choices for payments companies?

“I think a payments company should step back and look at how they see their future, and where they want to be in five years,” Søren said.

Some businesses may want to continue focusing on payments as their core offering and prioritise geographical expansion, while others will want to become more than a payments company by developing a rich proposition for merchants. Regardless of the strategic goal, the next step will be to assess how that vision will be best achieved – which includes deciding on whether to partner with third-parties, or develop propositions in-house. “I think the strategic choice will be – how do I want to grow and by which avenue?” Søren explained.

Branding – or the absence of it – will also be a key factor for payments businesses to consider. While heavily-branded solutions are easily recognisable, which can make consumers feel more comfortable in providing their payment details, there are also benefits in white-labelling a solution in order to provide a seamless customer journey.

“I would probably look toward the customer and what is important to them,” Søren said. “Is it comfort and recognition, or is it that they want a smooth and consistent journey with one brand throughout?”

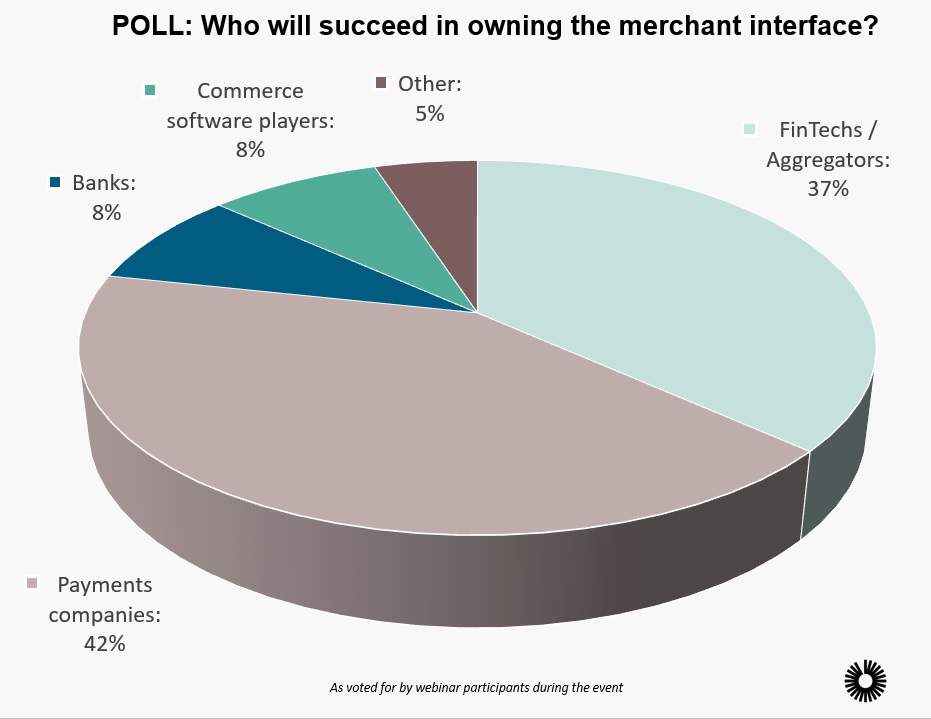

With consumers increasingly demanding a say in how the payment journey should look, it’s clear the landscape will continue to be competitive when it comes to who will own the merchant relationship.

“We are in dialogue with [payments companies] every day, and we know that they’re moving into this area and have a very strong opportunity to position this well,” Søren said. “They are very close to the merchant, and have ample opportunity to pull this through… Banks most certainly need to stay on their toes to remain relevant and ensure a very strong proposition towards their clients.”

You can hear Søren and Albion’s full insights by watching the webinar on-demand here.