Payments businesses and Banks traditionally send payments for their customers in their own name, rather than the name of their customer. That means businesses making payments for their customers appear as the sender to the recipient. This can lead to confusion on the recipient side, restricts customer branding opportunities and can create complications in reconciling payments.

Solutions such as Virtual Accounts and Dynamic Sender Name can resolve these pain points for the clients of Payments businesses.

Sometimes referred to as Payments-On-Behalf-Of (POBO), these solutions enable financial institutions to offer immediate visibility of the sender’s details when processing B2B payments. Modernising sender name, account numbers and other references, creates more flexibility for Payments businesses, and their underlying customers.

This post will explain the difference between the payment types offered by Banking Circle, and how the use of its modern banking infrastructure is enabling its Payments businesses to create new user experiences for their own clients, more transparency for payment recipients, and better reconciliation processes.

Flexible payment options

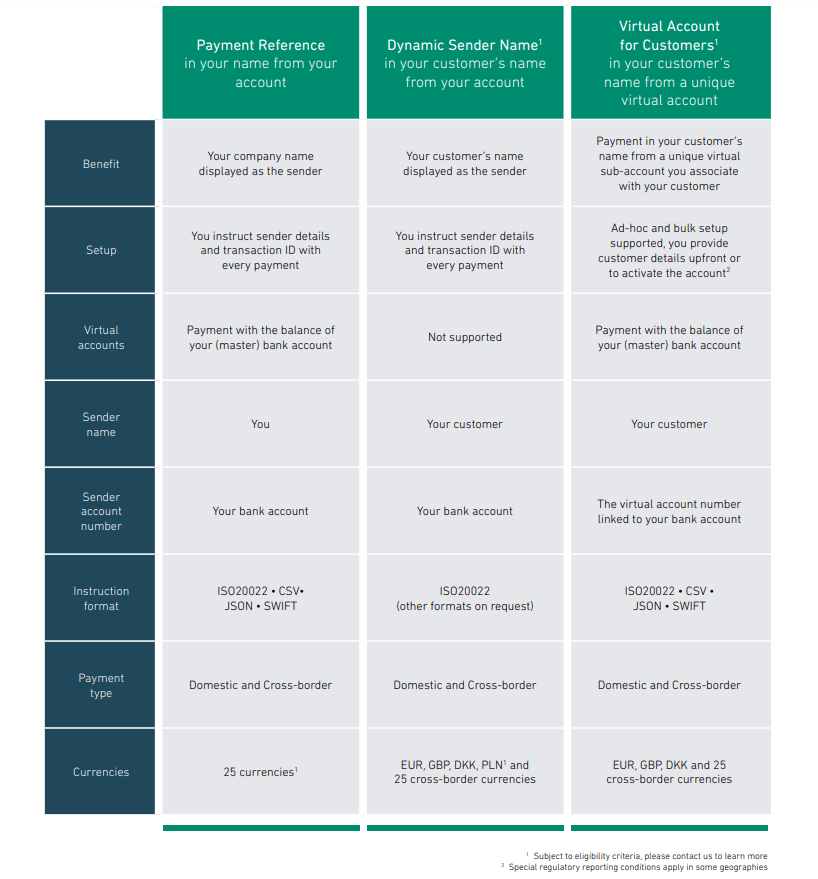

Banking Circle clients have three ways in which they can send payments, on a payment-by-payment basis, to ensure ease of reconciliation and increase transparency for the end receiver:

- Payment Reference – Include customer details including their name as a reference

- Dynamic Sender Name – Send payments from one bank account with different sender names displayed to recipients, or

- Virtual Account – Make the payment from a unique Virtual Account associated with that customer and in that customer’s name

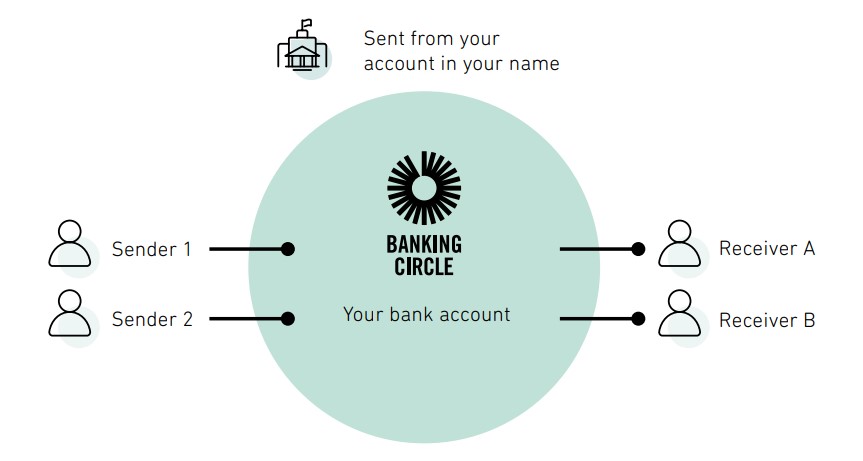

1. Payment Reference

Using this method, the account holder’s company name will appear as the sender name to the payment recipient. Information about the payer, the account holder, should be included in the reference field of the payment.

To comply with Wire Transfer Regulation (WTR), it is important to include a unique transaction ID in the payment reference field.

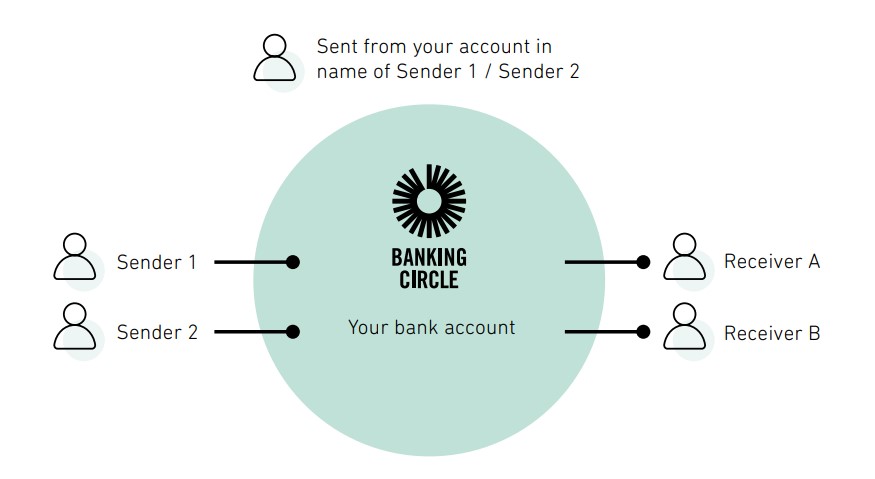

2. Dynamic Sender Name

This is the latest addition to the payment options available from Banking Circle.

Dynamic Sender Name enables Payments businesses to apply a different sender name for each new payment they send for their customers from the same bank account, as an alternative to opening a Virtual Account for every customer.

This is especially valuable for remittance businesses and those offering alternative payment methods, as these payments may currently arrive in the name of the bank or payment processor rather than the recognisable name of the sender.

Dynamic Sender Name improves transparency on the recipient side, making it easier to recognise payments, leading to more clarity for consumers and easier reconciliation for businesses.

As with the Payment Reference method, in order to comply with Wire Transfer Regulation (WTR), it is important to include a unique transaction ID in the payment reference field.

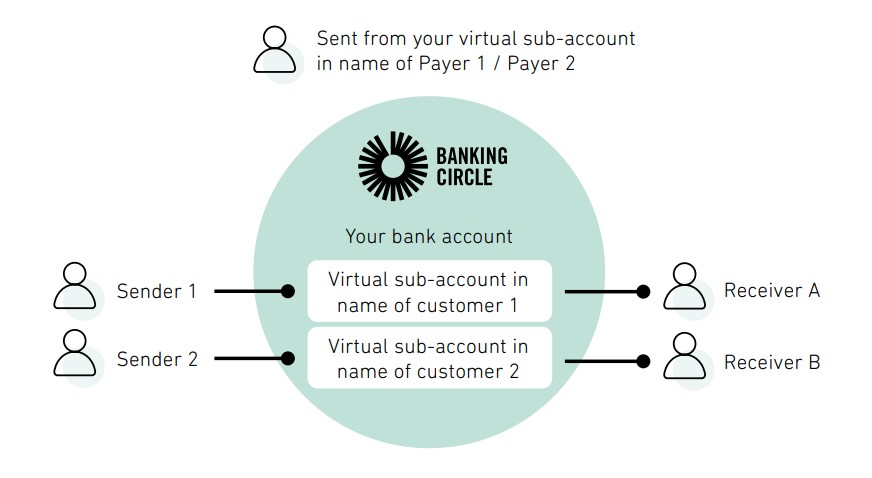

3. Virtual Accounts (Virtual IBAN)

This final option allows for the creation of an unlimited number of Virtual Accounts from which Payments businesses can send payments in the name of their customers. For each individual Virtual Account, which is tied to a single bank account held in the name of the Payments business, there is one name allocated for each segregated customer account, providing visibility on the sender’s details.

Virtual Accounts also have the functionality to allow Payments businesses to receive incoming funds for their customers.

Which is the best solution?

All payment types are both domestic and cross-border, and are available in 24 currencies. Banking Circle clients can choose the preferred payment method on a payment-by-payment basis, offering full flexibility to suit the requirements of each of their customers.

To find out more about our solutions for Payments businesses and Banks, contact the team at Banking Circle.