The international banking landscape is evolving at a rapid pace, and with more and more global economic activities involving cross-border transactions, it needs to. This, coupled with increasingly demanding expectations set by our lifestyles has resulted in the need for business payments to be much faster too. The influence of these factors will continue to drive digital transformations that look set to carve out a different international banking landscape.

A recent report by McKinsey predicts that in 2016 cross border electronic payments will account for 81% of the value of all global payments flows. This has grown by 16% in a decade – up from 65% in 2006.

It is expected that within the next decade we will see the formation of a single global online marketplace. Borders will become less relevant thanks to developments in technology and an increased appetite for products and services on a global scale. This will bring greater levels of cross-border commerce, with agile new payments platforms allowing for more individual participation in global flows than ever before. With new players being able to adapt to this landscape more quickly, how will incumbents, who have often believed they have an insurmountable wall protecting them from any major shift, react?

What do these changes mean for major banks? They need to rethink their strategy to be able to compete in the digital age.

The adoption of new technologies accelerates growth

Although incumbents have held significant market share for decades, the speed at which the adoption of new technologies can accelerate growth should be cause for concern. More than 30 years ago when Microsoft launched Windows, it took nearly 26 years to reach a billion users. By comparison, Android launched in 2008 and has reached a billion users in less than six years, highlighting how quickly the landscape shifts as technology creates new opportunities. FinTechs are aware of this, and are poised to move to replace banks by challenging the status quo.

Because FinTechs can focus on specialised, niche banking services, they can approach the financial market with new products – fast. They have no legacy and can be highly flexible. As a result, traditional banks will most likely become more relationship-driven and therefore focused on customer relationships. FinTechs will also enter the digital battleground due to regulations such as the Payments Directive opening up the market.

However, FinTechs are not the only threat to the incumbents. Cryptocurrencies, and the technology that drives them, could revolutionise the entire infrastructure that underpins the banking industry. Tech giants such as Google and Facebook, who have a huge amount of data on their users, could make a play to enter the finance sector. The ‘Internet of Things’ has the potential to provide e-commerce marketplaces like Amazon and Alibaba with a way to evolve into global financial marketplaces too.

What does the future hold?

The new digital financial landscape will feature banks and a whole host of other players competing for business and consumer clients with a strong focus on the overall customer relationship. Banks are recognising this, resulting in major banks including BBVA, Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo all making strategic investments in FinTech companies, according to CB Insights data.

The traditional banks are taking proactive steps to protect their dominance in payments, wealth management, and billing. That being said, it is very difficult to predict who will win the digitalisation battle because technology moves quickly and the market moves with it.

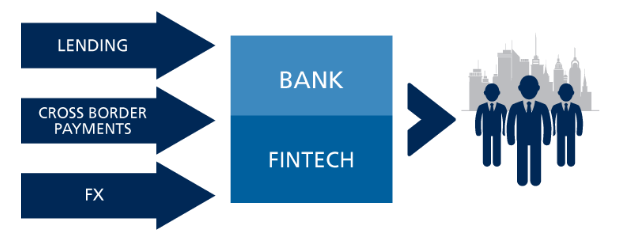

To ensure that they retain market share, it is likely that banks will invest more in building the customer relationship, while outsourcing non-core functions such as lending, FX and cross-border payments to FinTechs who can manage them more efficiently.

FinTechs, on the other hand, will keep gaining market share although they are likely to meet increased regulation. For example, larger tech giants like Apple, Google, Facebook and Amazon will increase their efforts to gain market share within the FinTech market.

In the next few years, the banking industry will evolve to be more fragmented, with the different ways of delivering “banking services” being far broader than we see today. Most importantly, the increased competition in the sector will ultimately benefit customers, making them the real winners.

Discover more about the evolving B2B cross-border landscape in our white paper ‘Cross Border B2B Payments – Today’s landscape; Tomorrow’s opportunity’.

"*" indicates required fields