The World FinTech Report 2020 published by Capgemini and Efma centres around a key theme – effective collaboration within a shared Open X ecosystem. But what exactly is Open X, and what does it mean for banks?

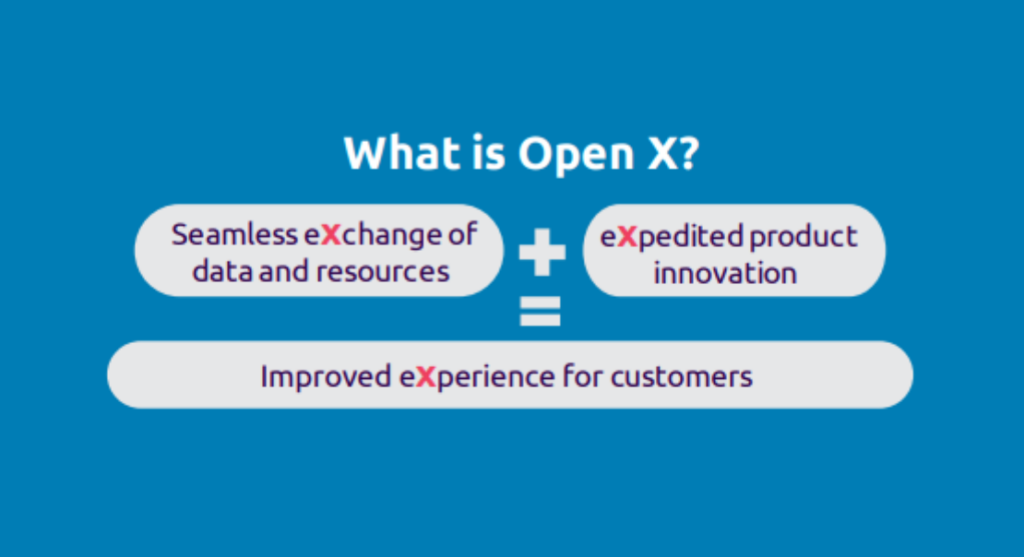

What is Open X?

Open X is an open platform approach that allows entities of all sizes and industries to collaborate in order to deliver specialised financial products.

By working together, the ecosystem is beneficial for all participants. As data, resources, and knowledge is shared, innovation drives better products and services, which improves the customer experience, helping to build trust and loyalty. Unfortunately, despite relationships being forged, many partnerships have not paid off. But why?

Partnership pain points

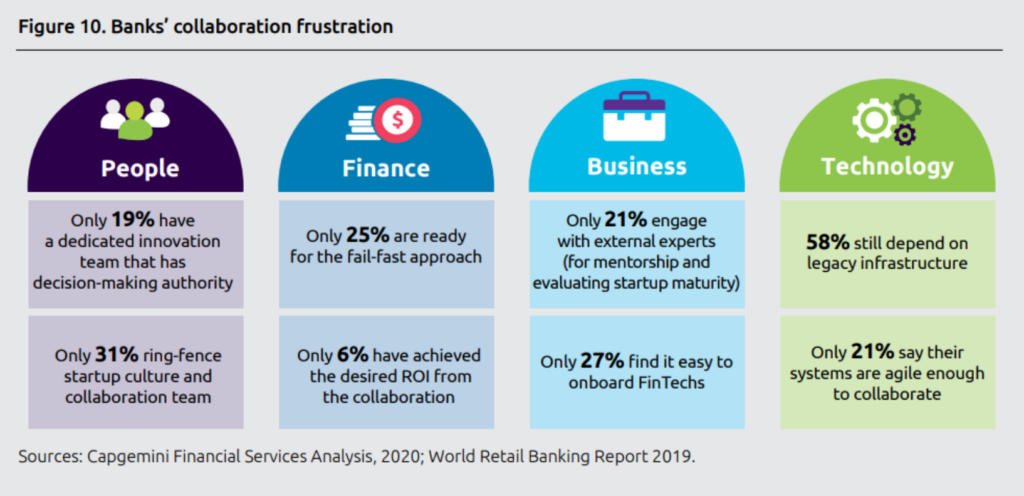

According to the report, banks and FinTechs have expressed frustration around the following pain points:

- Only 21% of banks say their systems are agile enough for collaboration

- Only 6% of banks have achieved the desired ROI from collaboration

- 70% of FinTechs don’t culturally or organisationally see eye-to-eye with their bank partner

- More than 70% of FinTechs say they are frustrated with the incumbent’s process barriers

- Half of FinTech executives say they have not found the right collaborative partners

A great deal of focus has been on the front-end, that is, banks have mostly invested in FinTechs that can help them improve the experience for its end users. FinTechs are agile enough to be able to scale and deliver new products more quickly, utilise customer data for improved personalisation, while providing a customer-centric, user-friendly experience. And banks know that customers are willing to make the switch to FinTechs who are able to offer more varied and tailored financial products that can integrate with other platforms and apps seamlessly. It was hardly surprising that banks began to prioritise seeking out partnerships with FinTechs that could provide this.

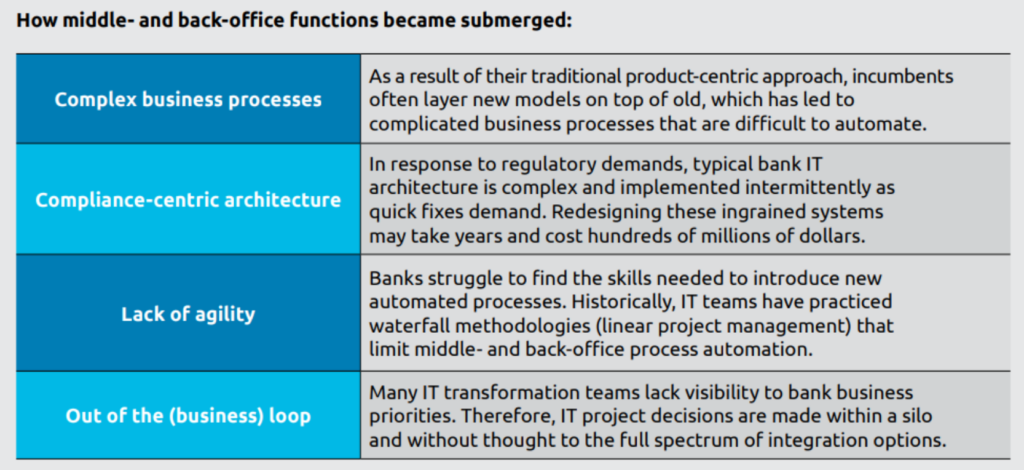

However, the reality was that banks and FinTechs – particularly startups – have very different operating models. Issues arise when an intuitive front end, which was developed by more agile FinTechs, turns out to be incompatible with the underlying infrastructure used by banks, making integration complex, or even impossible. Projects were abandoned as a result.

The optimisation of front-end functions is only one piece of a much larger puzzle. Until recently, banks have retained control of middle and back end processes, but this has been to their detriment, resulting in them being bogged down by issues associated with legacy infrastructure.

To be able to collaborate effectively, banks need to work with partners that can help them enhance their offerings, rather than attempting to shoehorn in solutions that simply will not work without first addressing underlying issues that occur further down the chain.

The emergence of the ‘Inventive bank’

Banks that are prepared to adopt specialised open ecosystem roles and complementary support from qualified FinTech partners, have been dubbed ‘inventive banks’ in the report. These inventive banks will be agile, customer-centric specialists prepared to face the new age of financial services.

For incumbents to be able to evolve into inventive banks, they need to:

- Invest in a dedicated collaboration team and encourage entrepreneurship

- Exhibit financial willingness to adopt a fail-fast approach to innovation

- Gauge the FinTech landscape by investing in hackathons, accelerators, and other mediums to find the best fit for a

particular business case - Partner with FinTechs able to offer scalable go-to-market solutions, allowing banks to meet targeted business

outcomes - Put trust in their partners to deliver solutions in the niche in which they specialise

- Embrace digital transformation by investing in emerging technologies

- Move away from legacy systems into open and evolutive platforms

Effective collaboration requires people, business, and process maturity from both incumbents and FinTechs, and achieving this is certainly not without its challenges. Whether traditional banks can get on board with Open X and transform into inventive banks is yet to be seen, but it will certainly be interesting to see what models they adopt to help them fill the gaps, and who will be the first to do so successfully.

Banking Circle can support banks with collaborative, white-label solutions to deliver the financial services infrastructure they need. To find out more, get in touch with a member of our team.